What is the difference between a 1099 contractor and a W-2 employee?

The differences between 1099 contractors and W-2 employees can be vast, but ultimately, one is not any better or worse than the other. What it really comes down to is which is the right fit FOR YOU. Today, let’s learn about some of the differences so you can make informed decisions on which type of employment you prefer!

What is a W-2 employee?

Most of us have probably already heard of being a W-2 employee. As a W-2, employees are typically hired at an hourly or salary rate and trained once hired for the position. Often times, benefits and 401k’s will be included as long as you meet the company’s requirements. To keep it simple, companies often give their team much more support, resources, and reliability when they are W-2 employees.

What is a 1099 contractor?

As a 1099 contractor, you are your own boss. 1099 is like the halfway point between owning a business and being an employee. As a 1099 contractor, you will still be under “contract” with a company to work with them. However, you are typically paid a sum of money without taxes taken out, and it is your responsibility to file, invest, and find benefits for yourself. Again, depending on the circumstances, this could cost more or end up saving you a lot of money in the long run.

Now that we have a basic understanding of what these are let’s talk about some of the differences between them and discover why we at Lighthouse Therapy contract therapists as 1099 contractors!

The Freedom of 1099 Contractors

Flexible Hours

As a 1099 contractor, you decide when and how much you work. At Lighthouse, we do ask that therapists expect a minimum of 20 students, but ultimately, how you schedule those sessions is completely up to you and your students.

Flexible Location

Another perk of being a contractor at Lighthouse is that everything is online. This means that your workspace is totally up to you! Whether you want to work in a home office or are alternating between a few locations, you can still work anywhere as long as you have a computer, microphone, and headphones. (We do still expect our therapists to look and act professional during their sessions of course.)

Flexible Pay

Another benefit that comes to mind is the flexibility of pay. As we said before, we do have a student minimum of 20 kids however, making more money is as simple as increasing your workload.

We always want the best services possible for the students we serve, so we try to incrementally increase students to your desired caseload so as to not overload you as soon as you start. However, we do have some therapists serving 60-70 students a week. Again, the main thing we keep in mind with this number is ensuring that students receive appropriate services first and foremost.

The Responsibilities of 1099 Contractors

As a 1099 contractor, you are your own boss. This also means, however, that you have the responsibility of being your own boss as well. Let’s dive into some of these added responsibilities.

Responsible Taxes

As a W-2 employee, the company you work for takes your taxes out automatically, for you to file and receive the returns you’re owed. As a 1099 contractor, it is expected that you will put some of your paychecks away to go toward filing your taxes on your own.

We recommend that you consult an accountant to help with this and make the process as smooth as possible. In doing this, you may find some tax breaks and write-offs that you never would’ve expected previously.

Responsible Retirement

As a 1099 contractor, there isn’t any automatic enrollment in a 401k. Because of this, investing part of your paycheck towards retirement is within your control. This gives you much more freedom to make the smartest investment decisions you can make.

Again, we recommend talking to an investment professional to get a clear idea of what to expect when saving up for retirement.

Responsible Benefits

I’m sure you’re seeing where this is going already. As a 1099 contractor, you get to choose your insurance coverage and what it costs you. As a W-2, if your employer offers insurance that doesn’t work for your family, you’re stuck with it. The higher rate of pay as a 1099 contractor affords you the ability to choose what insurance is appropriate for your family.

Overview

Clearly, there is a lot to consider when looking for what type of employment works best for you. We’re not here to mislead or paint a picture that simply looks pretty. We want to inform and prepare you to make the choices that best fit your needs.

If you’re looking for a job that is simpler from a tax and insurance perspective, then a W-2 is probably the choice for you. However, with that comes a lack of freedom and flexibility when it comes to a work/life balance. If you’re ready to take on the responsibility of being your own boss and taking care of your own needs, then being a 1099 contractor is probably the right choice for you.

Finally, if you’re leaning towards being a 1099 contractor, and you’re a speech-language pathologist, occupational therapist, or one of the many other kinds we contract, check out our jobs page for more info. We’re always looking for top-tier therapists.

I hope this makes the differences between 1099 contractors and W-2 employees easier to understand. If you’re still left with some questions, click here to go to our FAQ’s page. Thank you, and have a blessed day!

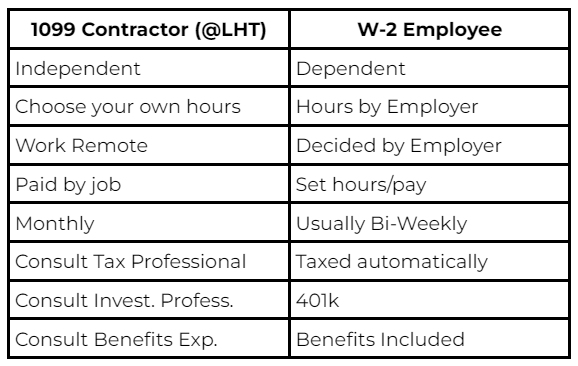

Key Differences